PIM for banking and insurance: Threats

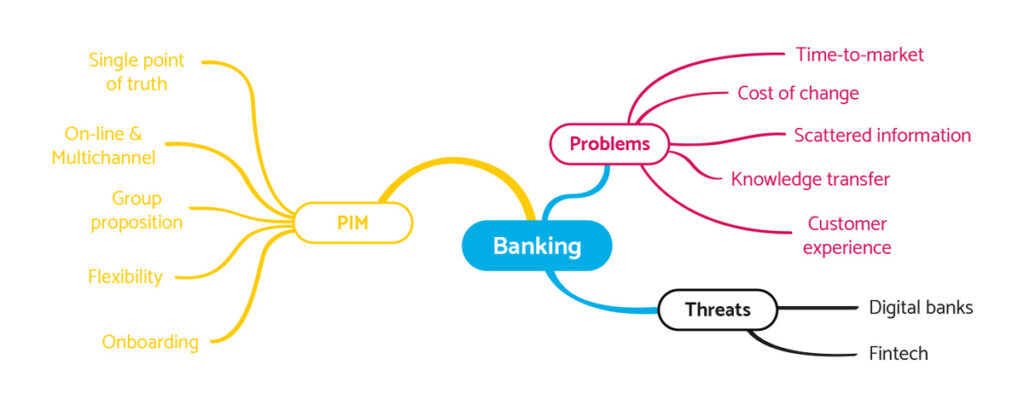

What does a bank or an insurance company need from the product management point of view to be able to digitalize their processes and keep up with the market? What are the main threats and opportunities they face in the area of product management? How can a product catalog (PIM) help?

Digitalization is a clear trend nowadays. No company that wants to survive in the market competition can afford to ignore this trend. Sales and service processes have moved online and self-service and automation started to replace sales representatives at branches.

However, properly working digitalized sales process is only a thin skin visible to customers. To be effective, it must be based on a whole range of technical and process support on the background that must be there in order for the digitalized sales process to hit the target. In this article we will focus on one of them, often omitted but extremely important: a clear, consistent, efficient and smart source of truth about the products across all channels and all steps of the sales process.

Why is it so important?

Let’s listen to the typical voices of people dealing in different roles with a financial company, which has been continuously building products without a central product catalog for many years. Various pieces of product logic were added where needed. Other pieces were added later – at different places. And more and more changes have accumulated across many systems, while people have come and gone and their knowledge has gone with them. What can we hear them say?

Voice of the business people

- Time to market: “Time to market for a new proposition is in months. But the market is evolving constantly. How can I meet my KPIs?”

- Costs of the change: “Everything has to be done by the IT. But IT is costly. Minor improvements have a negative business case, which will never be approved.”

- Flexibility: “I need the flexibility to test the market and optimize the proposition based on results. But our IT needs a fixed specification weeks ahead.”

- Effectiveness: “I have no clue how the product is reported, offered, approved, sold or managed. To get end-to-end information about all this you need at least 10 people in one meeting. There probably is some methodology for these processes, but it is outdated and nobody follows it.”

- Knowledge transfer and onboarding: “When a key colleague leaves, we are in trouble, he owns all the knowledge. Onboarding a new colleague takes months before he learns everything and becomes productive.”

- Complexity: “We sell 5 different current accounts but keep around 100 historical ones in our systems, just to be sure. No one knows what would break if we remove them.”

- Compliance: “It is hard to ensure that all sales representatives follow the rules properly. The system does not enforce our rules since the process is too complex and full of exceptions.”

Voice of IT and architecture

- Architecture: “How can we deliver the multichannel when we do not have one source of truth about the products? How do we consolidate the data when every system has different information?”

- Governance: “Product parameters and settings are managed across X different systems. It is hell to keep it alive and not to forget anything.”

- Knowledge transfer: “Our key colleague has been working here for more than 10 years. If he leaves, we are in serious trouble. All the knowledge leaves with him.”

- Priorities: “We spend most of our time supporting business operations and setting up some parameters in the systems. Instead of focusing on strategy and new development of future business enablers.”

Voice of the customer

- Customer experience: “Different sales channels and different sales reps provide me with different information. I am confused and it does not seem professional.”

- Customer satisfaction: “They promised to activate the account immediately. In the end, it took several days and a couple of calls to customer service until everything was set up properly. They have apologized for the troubles, but still …”

- Appreciation: “I have several million in loans with this bank and an excellent track record. Now I need one current account and they want me to pay for it? Do I have no value for them to give me a special offer?”

- Group brand perception: “Why should I get my own insurance when they have an insurance company in the same group?”

- Group proposition: “They acquired another company. As a loyal customer, I expect some benefits and synergies from it but nothing has been offered. Sales representative says that the systems are not integrated yet.”

- Focus on the customer and his needs: “They offer a lot of different products, but how should I choose the right one for me? I’m not a finance specialist, I just want to build a house and find the best financing option for it.”

So, what can we do?

If you work in a finance company with a long history and these voices sound unpleasantly familiar to you, do not despair. You can be sure that your competitors with a similarly long history face the same situation and troubles.

What is a real threat for you, are the new digital banks and fintech companies. They do not carry this historical debt with them and have a great opportunity to build a long-term, sustainable architecture from scratch, which will guarantee them flexibility on the market even after 20 years of existence.

How?

They know that to keep things in order, every piece of information should have one system where it is managed. Exactly one, not less, not more. And this system should be clever enough to be able to serve this information to all its consumers. Sometimes directly by providing the data on request, sometimes indirectly by notifying them about the updated information, so the consumers can store it locally and use it as they need to.

Products are not an exception to this rule. A product catalog (PIM) can play this governance and mastering role. If it allows you to define not only data but also logic, the better. And if it enables business users to manage the products directly, without IT as a necessary mediator, your problem is largely solved.

It brings transparency, clear governance and ownership to the environment significantly shortens time to market, reduces the cost of changes to a minimum, and lets the business users make as many changes as they need to.

Customers, as well as your B2B partners, receive consistent information across all channels and when they make an order it can be processed smoothly because the same, clean information is available across all systems.

In our next article, you can take a look at the new business opportunities which a proper PIM solution can bring when chosen and used to its potential.